Is the Rolex Daytona A Good Investment?

There is no doubt that the Rolex Daytona is a good investment and If you’re interested in the luxury watch market as an investor, you’ll already be aware that Rolex models unequivocally make for sensible purchases. Most Rolex models are notable by a continuous growth in value, coupled with a never-waning popularity. There’s something about these classic timepieces that just refuses to fall out of the public consciousness. For decades now, Rolex has captured the zeitgeist with each new release, while older models become more highly sought-after with each passing year.

With that in mind, it’s fair to say that Rolex watches are one of the best options for those who wish to make money from their luxury timepieces. The beauty of Rolex is that you can be both an investor and collector at the same time: this means enjoying the history and tradition of the brand while collecting instruments which are stable enough to retain value and in-demand enough to increase in value over the years.

Of course, it stands to reason that some Rolex watches are more suitable as an investment than others. Limited edition runs, timepieces with provenance and discontinued models can all command high price tags on the secondary market. Whilst all Rolex watches will hold their value, some will increase more exponentially than others, based on the basic tenets of supply and demand.

Is there a shortage of Rolex watches?

Anybody with even the slightest of passing interests in luxury watches will be aware that there is currently a widespread shortage of certain Rolex models. Despite an increase in production levels year-on-year, the demand for Rolex watches certainly exceeds supply levels, with some of the most desirable models on multiple-year waiting lists at retailers around the world.

But how did this shortage happen? To obtain the answer to this question, we have to consider multiple factors: an increased interest in Rolex watches, a fixed supply, and a renewed concentration of interest in certain models – such as the Rolex Daytona – have all combined to ensure that the markets are now buzzing with anticipation for the right reference numbers.

Why Is the Rolex Daytona a good investment?

.jpg)

The Daytona is one of the most suitable Rolex models for investment – if you can find one, that is. It is rare to find a Rolex Daytona at a concessionaire – instead, you’ll have to look to the free market. This of course means that Rolex Daytona prices have skyrocketed in recent years, to the point where many people will now pay double the list price to own one.

A case in point of this watch being a good investment is the Rolex Daytona 116500LN. It features an Oystersteel case, matching bracelet, Cerachrom bezel and screw-down crowns. It’s a timeless design, and even at first glance it’s easy to see why such a timepiece might be in demand – but you might be taken aback when you see just how much it has increased in value since its launch some four years ago.

Back at Baselworld 2016, the Rolex Daytona 116500LN launched with a list price of £9,600. In 2020, that same model is now changing hands on the secondary market for more than £22,500. It doesn’t take an accountant to figure out that it’s possible to more than double your money when you invest in the right Rolex model – and at present, it appears that the Rolex Daytona is very much in demand.

History of the Rolex Daytona

To understand why the Rolex Daytona is such a good investment, we perhaps need to consider the history of this iconic timepiece and the wider history of Rolex’s foray into chronographs. For much of the brand’s history, chronographs took something of a back seat to three-handed watches. While Rolex did produce some chronographs in the mid-20th century, they were housed in conventional cases (not the Oyster case we know and love today).

The origins of the Daytona can be traced back to 1955 when Rolex launched its 6234 model. The watch was simply labelled “Chronograph” without the words “Daytona” or “Cosmograph” anywhere to be found, and it wasn’t particularly successful. However, these proto-Daytona models are now rare and desirable and can command upwards of £20,000 on the secondary market.

By the late 1950s, automobile racing had captured the hearts and minds of millions around the world – and the USA in particular. By 1959, the newly-opened Daytona International Speedway was attracting attention as one of the finest asphalt-based racetracks in the world – and it needed an official timekeeper.

Rolex entered the fray as the official chronographer of the Daytona racetrack in 1962. By 1963, the firm had launched its 6239 Cosmograph, which was affectionately nicknamed the “Daytona” to emphasise Rolex’s affiliation with one of the most prestigious speedways in the world. The watch was designed specifically for racing drivers, which is why the tachymeter scale of the bezel is considerably larger than usual.

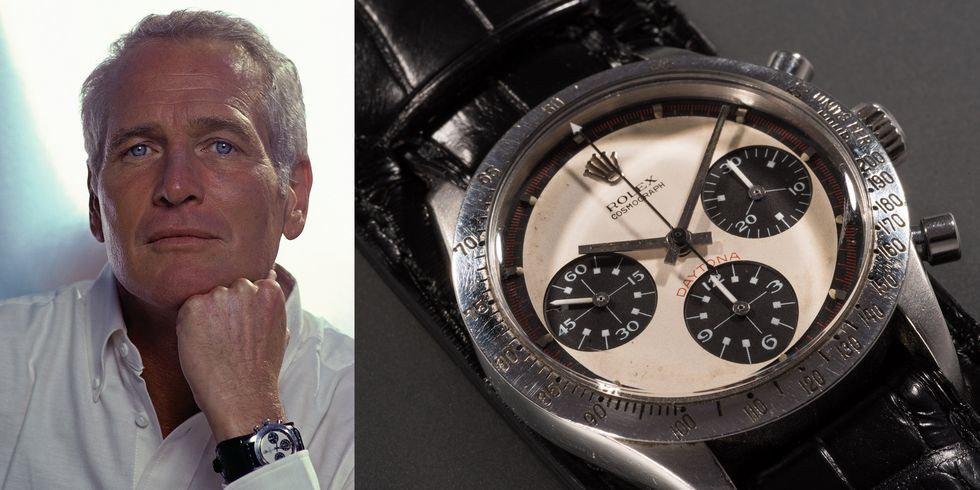

The Paul Newman Daytona

Image Source: TownandCountryMag

With style, durability and finesse, it should come as no surprise that the 6239 Daytona attracted a celebrity fan in none other than Paul Newman. While Newman was rightly revered as an actor, he was also an incredibly successful racing driver. When behind the wheel, Newman would wear his 6239 Daytona, which is chiefly recognised by the contrasting coloured second scale along the periphery of the dial. This model eventually became known among collectors as the “Paul Newman”.

Paul Newman Daytona models routinely sell on the secondary market for upwards of £65,000, depending on condition and provenance. Of course, there are fewer watches with greater provenance than the Paul Newman Daytona owned by the man himself.

Paul Newman’s very own Rolex Daytona – purchased in the late 1960s for approximately £230 by his wife Joanne Woodward, and inscribed with the words “Drive Carefully Me” as a reminder to take care while racing – went to auction at Phillips, New York during October 2017. Conservative estimates put the value of the watch at around $1 million (£780,000), but the hammer finally fell at a staggering $17,752,500 (£13,760,850), thereby breaking the record for the most expensive wristwatch ever sold at auction.

Other famous Rolex Daytona models

While Paul Newman’s Daytona might have taken the limelight, his is not the only Rolex Daytona of interest in the luxury watch market. Here are some of the most famous – and expensive – Daytona’s in the world:

Eric Clapton’s “Albino” Daytona

Image Source: Forbes

The “Albino” Daytona is an all-white model with a black bezel. It’s a fairly straightforward model – but this one, in particular, belonged to none other than Slowhand himself, the guitar virtuoso Eric Clapton. Back in 2010, it commanded $1.4 million (£1,090,000) at auction.

The Lemon Legend

Image Source: WatchCollectingLifestyle.com

The Rolex Daytona 6263 is finished in yellow gold, which is where it gets the “lemon” nickname from. There are just three Daytona known to exist in this colour scheme, and one of them sold for nearly £3 million at a Philips’ Geneva watch auction back in 2017.

Rolex 24 Winner

.jpg)

Source: DailySportsCar

Rolex 24 is one of the most gruelling motorsports events in the world. Those who manage to tough it out and finish in pole position are gifted a Rolex Oyster Perpetual Cosmograph Daytona, complete with an engraving of “Rolex 24 Winner”. Naturally, most winners tend to keep hold of their prize as a testament and memory of their accomplishments, but they do very seldomly appear on the secondary market. So seldomly, in fact, that it’s hard to even put a price on them.

Why is the Rolex Daytona so hard to find?

.jpg)

Ultimately, the Rolex Daytona is both in-demand and scarce. It’s not a model typically aimed at first-time buyers, and Rolex usually parcels out new models in limited numbers to a select few suppliers. Those suppliers tend to have loyal customers, who will usually pre-order a Daytona in advance of its arrival. It’s therefore virtually impossible to simply walk into a Rolex store and purchase one.

It’s also difficult to know exactly how many of these watches are out there. Rolex tends to decline to discuss distribution and production plans on new models, and every new release is essentially a scramble among collectors to get their hands on a prized piece of chronograph history. This means there will never be enough in circulation to satisfy demand.

For many collectors, the Daytona feels like the horological equivalent of the Holy Grail. Most dealers consider a two-year wait time as optimistic, with the more realistic ones considering five years more likely. While some collectors simply learn to manage their expectations, those with money to spare will happily pay over double the list price, thereby driving up the going rate on the secondary market.

Conclusion

.jpg)

The Rolex Daytona is certainly a great investment – if you can find one. While it’s not a typical high street purchase, the Chrono Hunter platform will allow you to track one down at a fair price – which is great news as an investor or simply as a fan of luxury timepieces.

Buy Or Sell A Luxury Watch The Smart Way With Chrono Hunter

If you are considering your new purchase or perhaps the sale of a beloved timepiece, Chrono Hunter is the smart way to buy or sell a luxury watch.

Compare Offers from the worlds most reputable luxury watch retailers.

Save Time.

Save Money.

Personalised Service.

Hassle-Free.

.png)