Business Watch: Luxury Swiss Brands Outperform Stocks, Gold And Bitcoin

In this exclusive, brand new series, Chrono Hunter introduces Business Watch - A look at the latest financial stories influencing the luxury watch industry. Oh you lucky watch peeps you! Our first article takes a look at how various Swiss brands including Rolex are outperforming several commodities including cryptocurrencies and shares.

- Prices of “holy trinity” members such as Patek Philippe and Audemars Piguet have surged in 2022.

- Secondary market explosion has resulted in price increase and unwavering demand for pre-owned luxury watches.

- Buying second-hand watches in 2023 continues to grow as timepiece lovers see luxury watches as a highly attractive investment alternative to stocks.

Money Talks As Vintage Watches Outperform Various Assets

Unlike the 7 time BAFTA winner, it seems it’s not All Quiet on the Western Front for the second-hand watch market. Now, if you buy a Rolex, you are pretty much guaranteed it will hold its value. From the iconic Submariner to the Daytona 116500LN, vintage Rolex watches are hot property. And this appears to be the case according to a recent luxury watch report by Morgan Stanley.

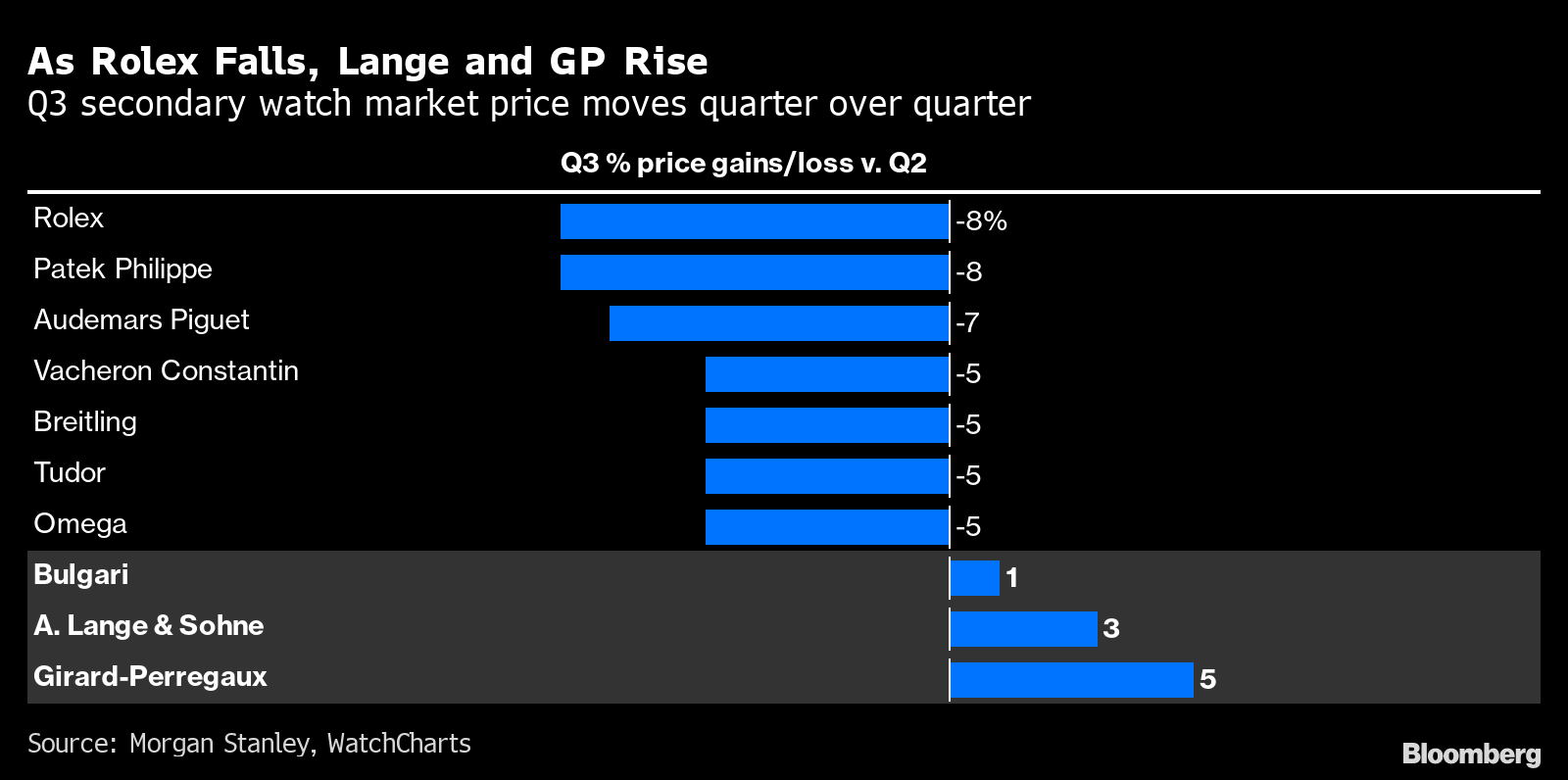

Source: Bloomberg

They revealed that Swiss watch brands such as Patek Philippe and Rolex have risen more than other assets including cryptocurrency and even stocks.

In fact the price of vintage watches decreased by only 8% last year in comparison to the S&P 500 which fell by nearly 20%. On top of this, the report declared that bitcoin fell sharply by a whopping 65%...Time is money and money is certainly time as they say!

In the last quarter of 2022, Morgan Stanley continued in their research note that other manufacturers such as Cartier and Omega had increased dramatically. Data from Watchcharts was their source of information which saw performance from both the NASDAQ Composite and S&P 500 fall heavily - the former by 33%.

But the fall in vintage watches was less than 10%, seeing Swiss brands profit on all fronts due to a number of factors. Whether you want to buy a Rolex or buy an Audemars Piguet, there’s still overwhelming demand and a lack of supply for pre-owned luxury watches.

Coupled with post-pandemic horological euphoria, rarity, exclusivity, celebrity influence and a new asset symbol, it has seen the secondary market erupt.

Ed Sheeran sporting the Patek Philippe Ref.5370 Split-Seconds Chronograph - worth £200,000+

Source: Wristenthusiast

Audemars Piguet, Patek Philippe and Rolex are admired by many watch lovers and collectors for their precision, manufacturing and iconic status such as The Royal Oak. Yet, these big three dominate the luxury watch sector, responsible for 70% of market share which has seen minimal impact. Despite the downward turn, this is a mere abrasion compared to the 65% Bitcoin crash and 33% decline of the S&P 500.

For Patek Philippe and AP, prices took a tumble by 7% while pre-owned Rolex prices only decreased by 5% in the last quarter of 2022. This resulted from price declines on notable models like the GMT Master II and Submariner. This is in spite of the 2023 Rolex price list which saw continual price augmentations.

Some have called it a price normalisation which has some impact on the luxury watch market but not enough to tumble catastrophically like many US stock indices or Bitcoin. In fact, other famous luxury watch brands such as Cartier, Omega and Rolexes sister brand Tudor recorded price rises in the last three months of 2022. Although the S&P went up nearly 5%, bitcoin decreased by 14% in the same time.

Second-Hand Rolex Watches and Their Value

Delving further into the figures WatchCharts claims that the cost of a pre-owned Rolex Daytona topped £40,000. At the time of writing, prices are closer to around £25,000 depending on the model, rarity and exclusivity. Tough times you might think but predicting prices are as unstable as the UK economy.

Rolex Cosmograph Daytona - Source: Rolex

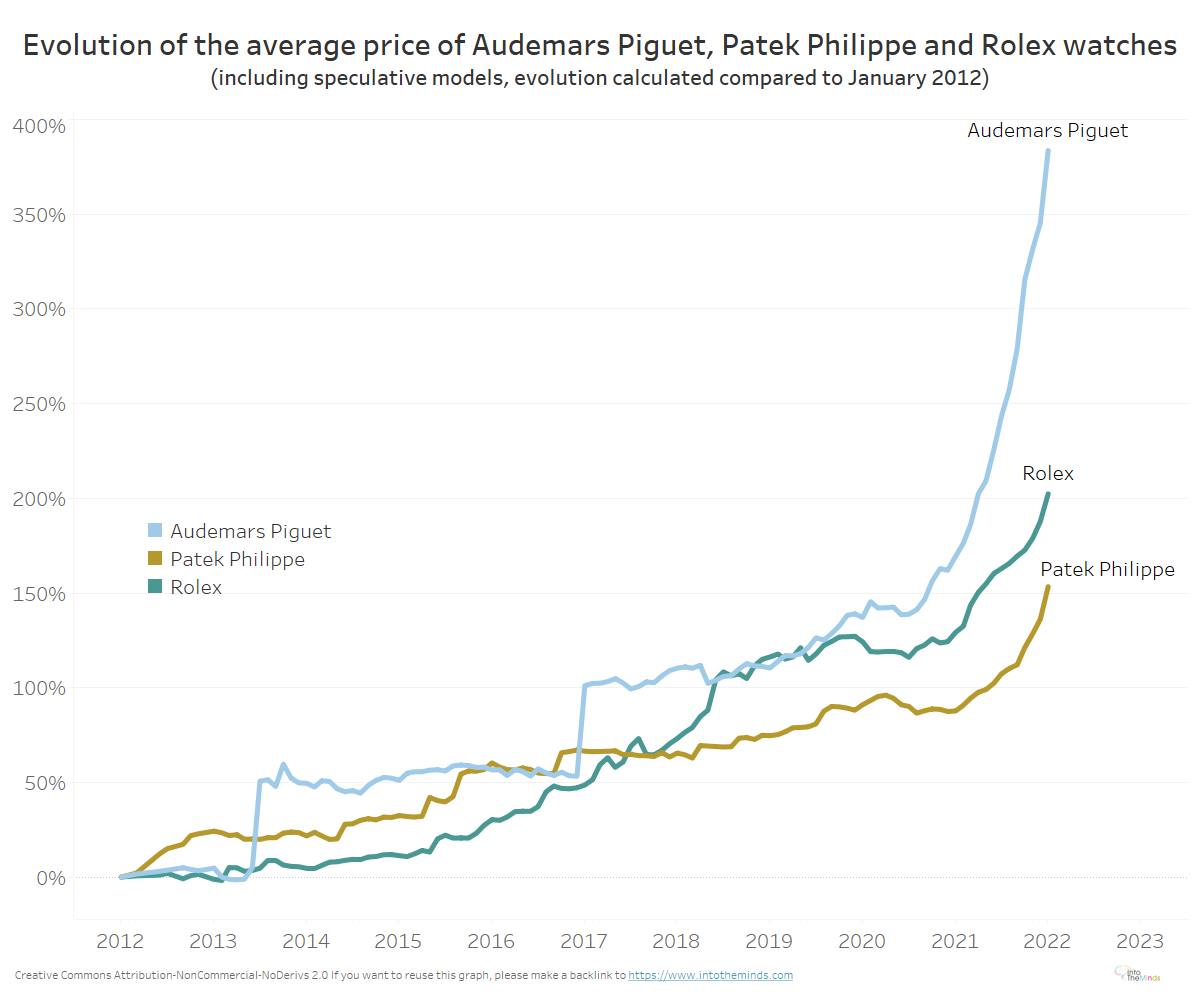

The beginning of 2022 saw Rolex prices catapult north before plateauing off by the end of 2022. Suffice to say, is Rolex a good investment? The answer is a well and truly resounding yes.

Since 2017, Rolex sales numbers have been growing rapidly with a massive increase in 2020. And even last year, you cannot buy a Rolex on average for less than around £11,000. This is in stark contrast to 2011 figures where the average price was approximately £4,000.

If you can get hold of a Rolex, it will be twice if not three times as valuable before you even walk out of the store…Yikes! Then you have to find an AD (Authorised Dealer) to buy a Rolex from if they let you. Or, be prepared for a wait as long as getting tickets for Wimbledon Centre Court.

The Rolex waitlist is as mythical as Jason and The Argonauts. People pick numbers from their heads with some waiting years for their name to appear on the list or that they are not selling to a flipper.

Rolex vs Gold, Real Estate and Stocks

It won’t take us any time at all to tell you that Rolex is the most Googled watch brand online, receiving in excess of 700,000 searches monthly.

Source: Intotheminds

As a valuable investment, the Genevan giant has seen it outperform a range of asset classes like gold and real estate over the last ten years. Prices are above retail even though they took a slight dampening last Spring. This is because Rolex watches more than hold their value as a long term investment, enticing many who want to buy a Rolex or sell a Rolex.

Since 2017, real market value is one thing but with the emergence of the robust secondary market, it has seen Rolexes come into their own as a worthwhile investment. Demand is outstripping supply…never mind that Rolex produces around 1 million watches a year.

Rolex Manufacturing Facilities in Geneva - Source: Gulfbusiness

In addition, there are other reasons why you should invest in a Rolex. The Swiss brand is also looking to guarantee even more authenticity on their supply thanks to the launch of the certified pre-owned programme. Introduced in December 2022;

"The new programme makes it possible to purchase pre-owned watches that the brand itself has certified and guaranteed. Its aim is to bring added value to the existing supply of pre-owned Rolex watches. Because when these watches change hands, their authenticity must be attestable at the time of resale by the Official Retailers," Rolex announced in a press release.

Conclusion

If you are looking to buy a Rolex on the secondary market, this sector shows absolutely no signs of abating. Cost of living crisis you say? Pah. According to McKinsey, they predict the value of the pre-owned luxury watch industry is currently valued at a staggering £16.5 billion.

This is set to grow by a whopping 33% to £24 billion in just two years. Inflation, demand, Rolex secondary market prices and other luxury watch brands like Patek Philippe are factors in driving demand even further.

Together with the new millennials' thirst for watch collecting as well as new digital platforms, the pre-owned luxury watch market is going to swiftly become the most rapidly growing sector. It is not just those who want to buy a watch for the sheer heritage or craftsmanship, nor visual aesthetics, design, functionality or status.

It’s more a case of owning a piece of luxury refinery that’s considered a genuine investment asset that will more than likely hold its value over a longer period of time. Plus the Chinese are back in the mix which will see more interest.

We reckon pre-owned Rolex watches will rise again in 2024 but don’t bet your bottom dollar on it watch fans. Unlike real estate or a launderette, there is no guaranteed regular income stream. This is pure speculation, something that you will find in predicting whether prices will go up.

With the secondary market increasing in popularity, isn’t it about time you visited Chrono Hunter? We are the go-to digital platform if you want to buy a Rolex or sell a Patek Philippe. Download our dedicated app today or contact us here and start the process immediately.

Whether buying a watch or selling a watch, we have an extensive selection of the most trusted luxury watch retailers and dealers, giving you the best offers on the market and in real time. Experience first class customer service and guidance from our expert team who are on hand to guide you through the process from the beginning right through to the end of your transaction.

Discover, hunt, buy, sell

Further Reading:

Sell Your Rolex - The Ultimate Guide

Question Time: What Can I Buy Instead of a Rolex Datejust?

Buy Or Sell A Luxury Watch The Smart Way With Chrono Hunter

If you are considering your new purchase or perhaps the sale of a beloved timepiece, Chrono Hunter is the smart way to buy or sell a luxury watch.

Compare Offers from the world's most reputable luxury watch retailers.

Save Time.

Save Money.

Personalised Service.

Hassle-Free.

.png)